A plan to expand Michigan’s Earned Income Tax Credit advanced out of a state Senate committee Tuesday in the first hearing of the legislative session.

The credit offers a tax break for low- and middle-income workers based on the federal EITC.

Senator Kristen McDonald Rivet (D-Bay City) sponsored the bill. Her proposal would raise Michigan’s EITC supplement to 30%. That’s five times its current rate of 6%.

“The difference in the 6% and the 30% is actually worth up to three credits at a community college. Think about how transformative that’s going to be for our economy and I very strongly believe that we needed to get that kind of assistance into family’s hands as fast as we possibly could,” McDonald Rivet said after Tuesday’s hearing.

During the meeting, the Senate Housing and Human Services Committee voted to update McDonald Rivet’s original proposal to get rid of a staggered increase that would have kept the 30% rate from kicking in until 2026.

The version of the bill is also retroactive so residents could start claiming it on this year’s tax forms.

“Essentially you would file your taxes, you would get the expected refund and then there would be a second check that would come along, however long that administratively takes to make sure that entire amount is applied to the 2022 tax year,” McDonald Rivet said.

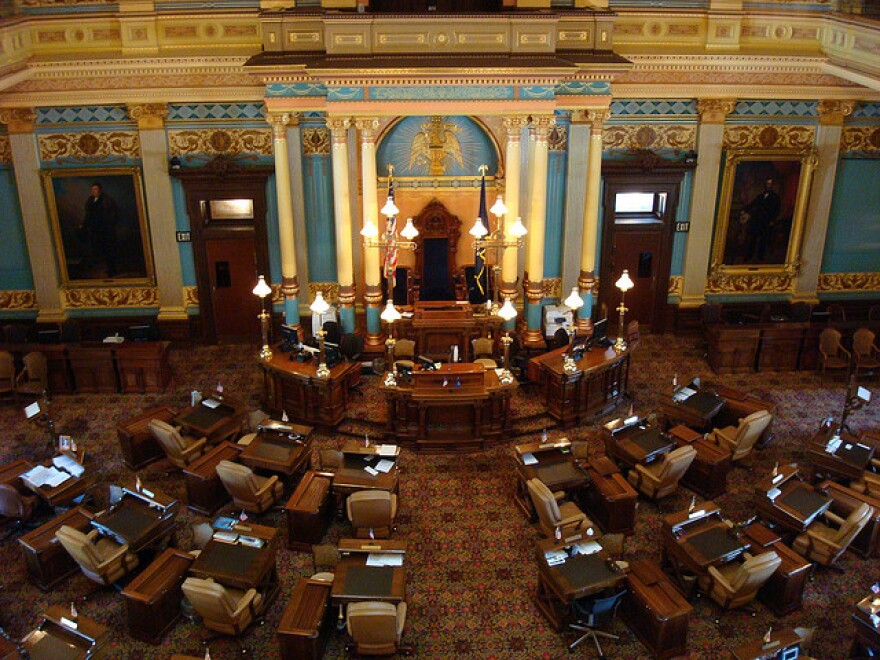

On the other side of the Capitol, two separate proposals for an EITC expansion are before the House of Representatives.

Both proposals would grow Michigan’s EITC to 20% instead of 30% but only the Republican plan would be retroactive.

“We’ll work through the 30%. We put up 20%, they put up 30%. That’s fine. All we wanted was retroactivity,” House Minority Leader Matt Hall (R-Richland Twp) said.

House Democrats have also indicated they’re willing to go along with a retroactive proposal.

During Tuesday’s committee hearing, several groups including the Small Business Association of Michigan and Michigan League for Public Policy testified in support of the Senate plan.

But critics are still raising concerns about whether an EITC expansion is the best use of Michigan’s resources and its estimated $9 billion surplus.

James Hohman is the director of fiscal policy at the Mackinac Center for Public Policy. He said he’s worried about the risk of improper payments.

"Many ineligible people making claims do not know the eligibility rules and documentation necessary to justify their credits. The state’s credit makes a large number of people accidentally violate the tax code, and that’s not good for them,” Hohman said in written testimony submitted to the committee.

During an interview, he questioned whether everyone who qualifies for the credit needs the extra support.

“Lawmakers can and should look at some issues that are more targeted at the people they want to help. That are more likely to be collected by eligible recipients. And they ought to have that conversation instead of doubling down on this federal program,” he said.

Lawmakers are not giving a timeline for how quickly they expect to see the EITC bill make it out of the Senate. But it is among the first bills introduced on both sides of the Legislature.