Rick Snyder said the Michigan Business Tax was bad for business.

“I propose replacing it with a flat six-percent corporate income tax. Let’s take a job-killer environment; let’s start creating jobs.”

He said it on the campaign trail. He made the point to business leaders.

“You’re paying tax on your individual tax return and then you’re paying a second tax. And for some people the effective tax rate could be over ten-percent. That is not how you create a job.”

And after the tax restructuring was approved by the legislature, Governor Snyder made the point again during a joint news conference with fellow-Republicans.

“It’s about really energizing our private sector to go out and create jobs because government doesn’t create jobs. And we’re all in fierce agreement on that principle.”

But does cutting the business tax for most small business actually create jobs? To be fair, Republicans have clarified that cutting business taxes is a factor in creating jobs and they don’t want to predict how many or when those jobs will be created.

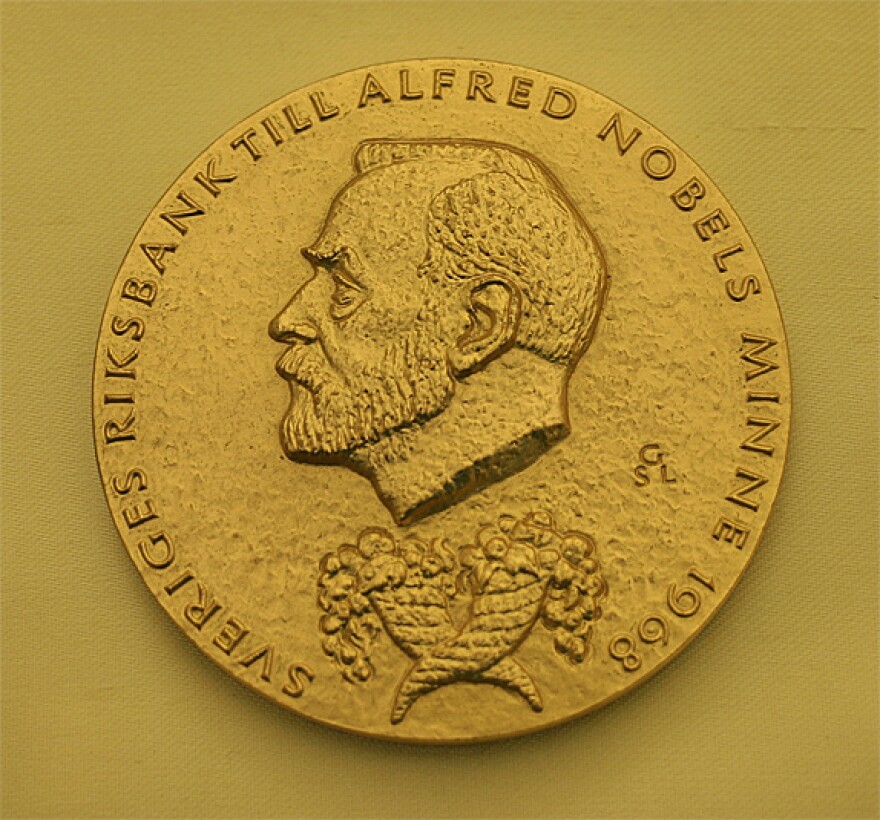

Now, I certainly don’t know whether cutting business taxes will create jobs, so I emailed every living Nobel Prize winning economist in the country and asked, “Is that true? Will cutting the state business tax for most businesses create jobs?”

I heard from about a fourth of the Nobel-laureate economists and the response was a mixed bag. Some said, 'Absolutely. Cutting the business tax will create jobs.' Some said, 'Not necessarily. State taxes are just one small factor in job creation.' Others said, 'That goes beyond my field of study. I couldn’t comment on that.'

So, the best and brightest economists in the country—at least as measured by the Nobel committee—don’t agree on whether cutting a state business tax will create jobs.

That was a bit of a puzzle. I mean, the study of economics is a science, right? Why isn’t there agreement on such a simple question?

Charles Ballard is an economist at Michigan State University. He says studying economics isn’t as exact as, say, measuring the distance to the moon.

“Economics, because it involves people which are complicated creatures, is less precise.”

He says while there is some broad concensus on economics in general, there are just so many factors that go into whether jobs are created, it’s hard to determine if cutting taxes creates jobs.

“What you want to do, the thought experiment that you want to perform is: if Michigan were to change its business tax and nothing else in the entire universe would change, what would that do to employment? But, of course, everything else in the entire universe is changing all the time.”

And the economy doesn’t really recognize the Michigan state border. Michigan is part of the larger Midwest economy, which is part of the national economy, which is part of the world economy. Teasing out the effects of a change in the state tax structure would be very difficult.

So you have to ask the business people who create jobs about whether this tax restructuring will prompt them to hire. That’s what the Small Business Association of Michigan did. Rob Fowler is the President and CEO of the group. His association surveyed its membership. About 450 small business responded to questions about how they might use the money they’ll save under this new tax restructuring.

“Add employees, 48% said yes. Expand your business, 52% said yes. Buy new equipment, 51% said yes. Raise wages and benefits for your current employees, 50% said yes. Realize the profits, that is, take the profits, 50% said yes. And obviously those don’t add up to a hundred, so what they were telling us is, ‘We’ll do some combination of these things.’ I would argue all of those things are positive for the Michigan economy, including ‘realize the profits.’”

Now, keep in mind, the new business tax doesn’t go into effect until the start of next year. So, this is what these small business owners say they intend to do.

“ Nobody has received a tax break yet. Nobody. And they won’t until January. Yet, there are companies who are telling us—these are anecdotes at this point—that based upon that, they feel comfortable to move forward with an expansion. Real companies, real employees being added right now.”

Fowler says besides a simpler tax structure and the tax cuts many of these businesses will get, there’s a larger point. He says Michigan business leaders have been complaining so long about the complicated and higher Michigan Business Tax and its predecessor, the also unpopular Single Business Tax that other businesses that might have expanded to Michigan just might have been scared off. This simpler, lower tax will help small businesses and just might be the kind of PR that Michigan needs to attact investment.

“The anecdotes we see today, part of the reason I’m so optimistic is because I think it was good timing in the economic cycle, I think it was good messaging to Michigan businesses. I think our businesses who sat out an entire recession and recovery are poised, are ready to go.”

So, there’s some anectdotal support for this ‘cut taxes, create jobs’ statement.

But, while many businesses are seeing their taxes cut, many individuals will see their taxes go up. And that has an economic consequence too.

Craig Thiel is with Citizens Research Council of Michigan, a nonpartisan public policy research group.

“Clearly there’s going to be some stimulative affect on the business tax cut that takes place, but that’s going to be offset by a dampening affect on individuals, those people’s whose incomes now are going to be reduced because of their increased tax liability.”

The increased tax liability is a tax on pensions as well as the removal of a number of credits and exemptions that all taxpayers get right now.

So, the individual income tax changes are going to reduce the amount of money people have to spend.

“And that disposable income’s used to consume goods and services. So, they’re not going to be going out to breakfast as much, they’re not going to be buying a TV as frequently, they’re not going to be maybe investing those dollars in other products made in Michigan or elsewhere.”

And that could mean fewer dollars for Michigan businesses which might make it harder for them to expand or hire more people.

So, where’s that leave us? The fact is, not even the Nobel-winning economists can agree on an answer. The statement cutting business taxes creates jobs is not a proven economic principle. It’s a political statement, a sort of article of faith. A hope.