The Michigan Department of Insurance and Financial Services says a new report shows the state's 2019 auto no-fault law lowered insurance rates for drivers, and also decreased the number of uninsured drivers on the road.

It's not true.

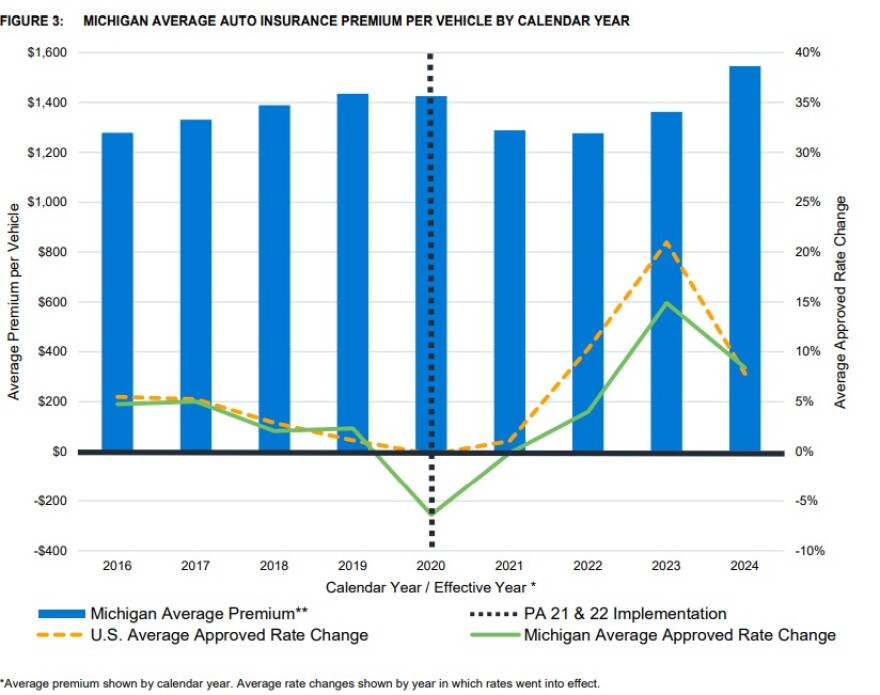

The report by the consulting firm Milliman on the impact of the law shows that, on average, rates have increased by close to $200 from 2019 to 2024.

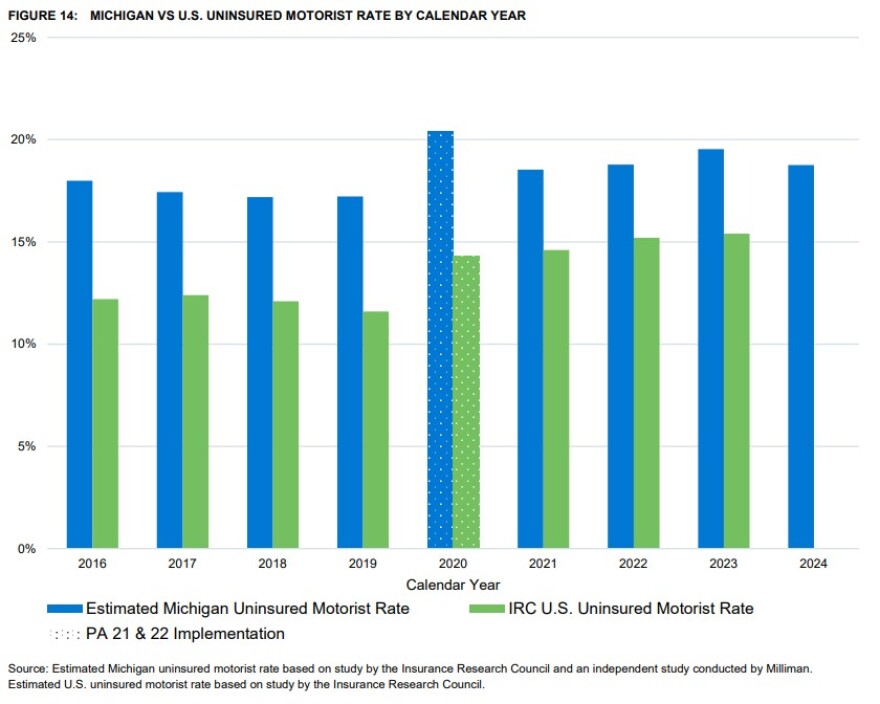

In its December 2 press release, DIFS also misrepresented the report's findings on uninsured drivers, claiming the number had gone down. In fact, there are more uninsured drivers now than before the reforms were enacted.

The report, requested by the Michigan Legislature and commissioned by the state's Department of Insurance and Financial Services, said drivers had saved about $357 a year on average, largely based on one portion of car insurance premiums: the Personal Injury Protection, or PIP, portion.

PIP pays for medical care for injuries the insured driver and passengers sustain in crashes. But those savings were essentially swallowed by sometimes double-digit rate increases approved by the Department of Insurance and Financial Services over the years. And while car insurance costs in Michigan did dip after the 2019 reforms, they soon began rising again, with 2024 the most expensive year the report measured.

To arrive at its savings figure, the report relied on a series of assumptions about what would have happened to insurance rates if the 2019 auto no-fault law hadn't been enacted.

"It is not possible to accurately measure the effects of (the no-fault law) by simply comparing actual average pre- and post-reform premiums because the period during which the reform was implemented and thereafter was heavily impacted by the COVID-19 pandemic," the report says.

Doug Heller, a car insurance expert with the Consumer Federation of America, called the DIFS statements a form of gaslighting.

“When you have to make adjustments based on assumptions to prove your points, you might not have a good point,” Heller said.

"People in Michigan know the truth, they see it in their pocketbooks," he said. "It looks like the state is either trying to protect the interests of the insurance companies, or embarrassed and trying to cover up its own failure to achieve the reforms that were promised."

A spokesperson for DIFS doubled down on the inaccurate or misleading statements when contacted for a response by Michigan Public.

"For 2024, Michigan drivers saw an average overall savings of $357 per vehicle," the spokesperson said in an email, and, "the Milliman report states that the reform decreased the uninsured rate."

That's despite data in the report indicating that the proportion of people in Michigan driving without insurance rose since before the law's implementation. What decreased was the gap between Michigan's uninsured rate and the uninsured driver rate nationally.

The report also attempted to address the issue of the law's impact on catastrophically injured people. The no-fault law made steep cuts to the payments that home care companies receive for caring for injured crash victims.

The authors said they were unable to form definitive conclusions based on limitations in the data, but found that 3,949 crash victims per year in Michigan will exhaust their medical coverage provided by their insurance company.

“This report paints a devastatingly incomplete picture of the state’s landscape for anyone who needs care following a catastrophic accident,” said Tom Judd, executive director of the Michigan Brain Injury Provider Council. "The no-fault law has created significant barriers to access to care for the most vulnerable and severely injured people."